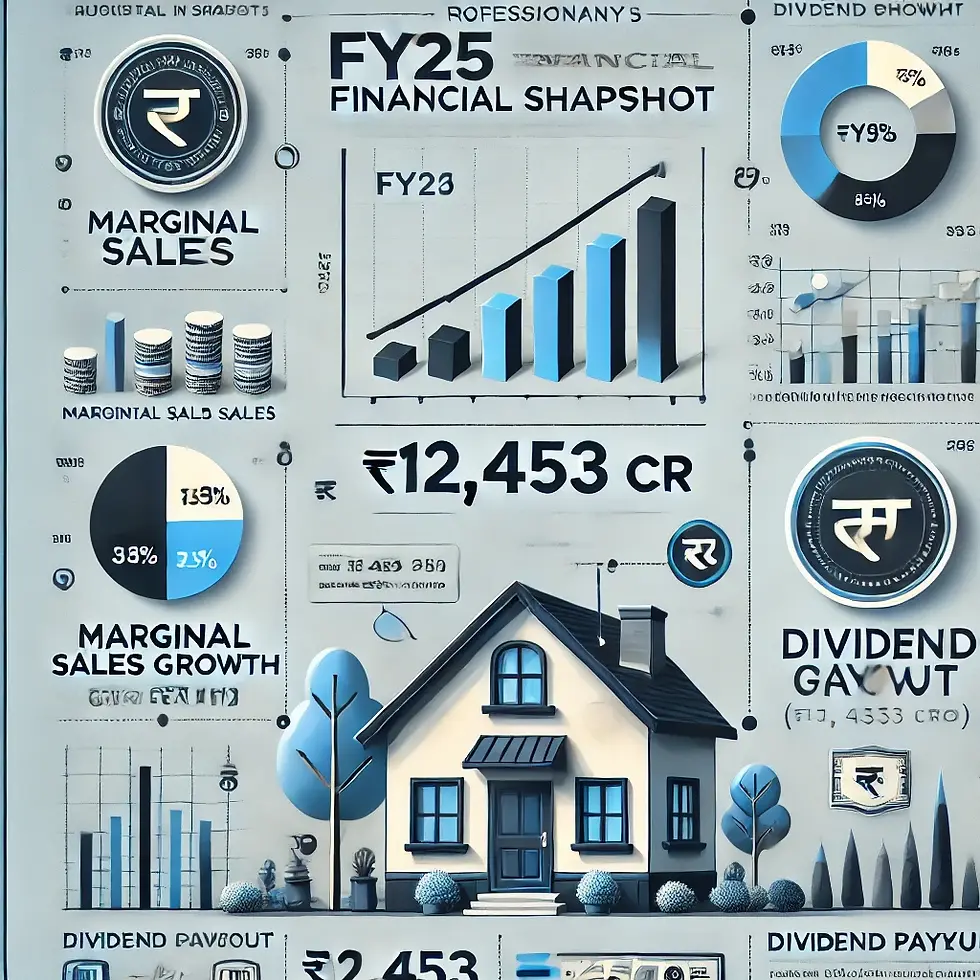

HUL FY25 Financial Snapshot: Marginal Sales Growth, Dividend Payout Hits ₹12,453 Crore

- nvshah0610

- Jul 29, 2025

- 2 min read

Hindustan Unilever Ltd (HUL) reported its financial performance for FY25, showing marginal growth in sales amidst a challenging consumption environment. The company posted a slight increase in its overall revenue, reflecting the ongoing sluggishness in rural demand and muted volume growth across several segments. While urban markets showed relatively stable demand, the overall topline remained under pressure, highlighting the broader economic slowdown in the fast-moving consumer goods (FMCG) sector.

Despite the modest sales growth, HUL maintained strong profitability, supported by its premium product portfolio and operational efficiencies. Strategic cost controls and supply chain optimization helped the company sustain its margins. The beauty and personal care segment continued to be a strong contributor, while the home care division saw limited growth due to stagnant demand for discretionary products. Foods and refreshment categories, however, showed signs of resilience, aided by innovations and product diversification.

One of the key highlights of FY25 was HUL’s dividend payout, which reached ₹12,453 crore. This marks a significant distribution of profits to shareholders and underscores the company's strong cash flow and commitment to returning value to investors. The payout is among the highest in the company's history and reflects its stable balance sheet and robust financial position.

Looking ahead, HUL remains cautiously optimistic about the recovery in rural consumption, with expectations of a demand revival in the second half of the fiscal year. The company plans to continue investing in brand building, digital transformation, and sustainability initiatives to drive long-term growth and remain resilient against macroeconomic headwinds.

In addition to its financial performance, HUL emphasized its focus on innovation and premiumization as key levers for future growth. The company continued to expand its digital and e-commerce presence, which contributed meaningfully to overall sales, especially in urban areas. Sustainability remained a core part of its strategy, with ongoing efforts in plastic reduction, water conservation, and responsible sourcing. Management reiterated its commitment to long-term value creation by balancing growth with profitability and maintaining agility in a dynamic market environment.

Comments