Nestle Financial Perfomance FY 2025

- nvshah0610

- Jul 1, 2025

- 1 min read

Updated: Jul 2, 2025

Nestle India, known for iconic consumer brands like Maggi, Nescafe, KitKat, and Cerelac, has consistently been a high-performing and dividend-paying company. The potential bonus issue reflects the company's strong financial position and commitment to enhancing shareholder value.

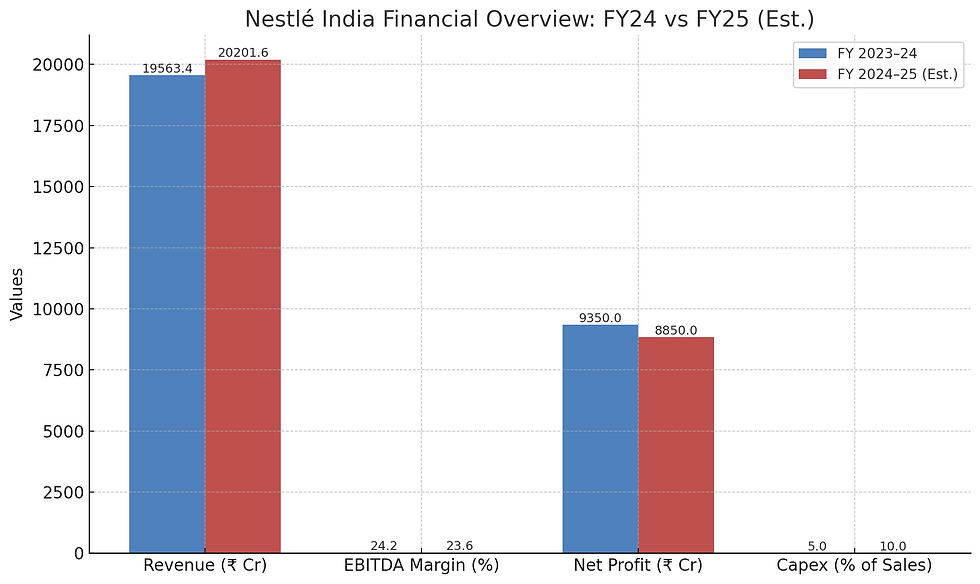

The Maggi owning company reported a net profit of Rs 873.46 crore for the quarter, a decline from Rs 934.17 crore in the same period last year. This marks a year-on-year (YoY) decrease of Rs 60.71 crore, or approximately 6.5%.

Despite the fall in net profit, the company posted a steady increase in its top line. Revenue from operations rose to Rs 5,503.88 crore, up from Rs 5,267.59 crore a year ago, showing an increase of Rs 236.29 crore or 4.5%.

Metric | FY 2024–25 Value |

Revenue | ₹20,077.50 crore |

Profit After Tax (PAT) | ₹3,314.50 crore |

Operating Cash Flow | ₹2,936.30 crore |

Dividend Payout | ₹2,603.23 crore (₹27/share) |

Proposed Final Dividend | ₹10/share (₹964.16 crore) |

Return on Avg. Equity | 88.9% |

Comments