strong financial performance for fiscal year 2024-25 (FY25)!

- nvshah0610

- Jul 29, 2025

- 1 min read

Total Revenue from Operations: ₹525,784 million (~₹52,578 crore), reflecting a 9% growth compared to FY24.

Gross Sales: ₹520,412 million (~₹52,041 crore), up 9%.

EBITDA: ₹152,717 million with an EBITDA margin of 29%, showing a 17.3% increase year-over-year.

Net Profit (Reported): ₹109,290 million (~₹10,929 crore), an increase of 14% YoY from ₹95,764 million in FY24.

Adjusted Net Profit (excluding exceptional items): ₹119,844 million (~₹11,984 crore), up 19% from the previous year.

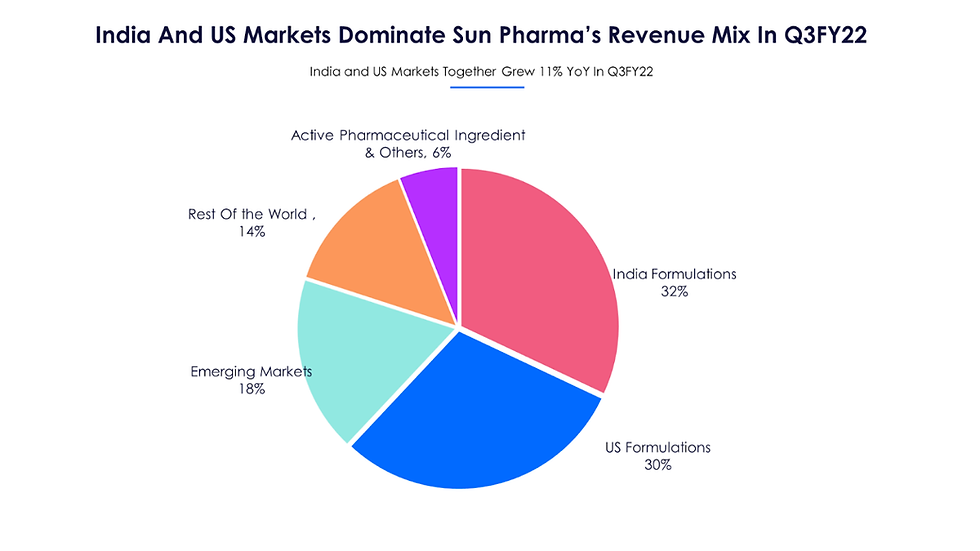

India Formulation Sales: ₹169,230 million (~₹16,923 crore), grew 13.7%.

US Formulation Sales: Grew by 3.6% to approximately US$1.92 billion.

Global Specialty Sales: Increased 17.1% to approximately US$1.216 billion, contributing about 19.7% of FY25 sales.

Emerging Markets: Sales up by 7%.

R&D Investment: ₹8,166 million (around 6.2% of sales), focusing heavily on specialty drug development.

Dividend: Total dividend for FY25 was ₹16 per share (₹10.50 interim + ₹5.50 final).

Quarterly details for Q4 FY25 included:

Revenue of ₹129,588 million

EBITDA at ₹37,161 million with 28.7% margin

Reported net profit of ₹21,499 million; adjusted net profit was ₹28,891 million excluding exceptional items.

These figures illustrate Sun Pharma's solid growth, operational efficiencies, and strategic focus on the specialty and domestic markets, as well as increased R&D spend fueling innovation and portfolio strength.

This detailed financial statement overview is based on consolidated audited results for FY24-25.

Comments