What role did cost control and expense management play in margin growth

- nvshah0610

- Jul 29, 2025

- 2 min read

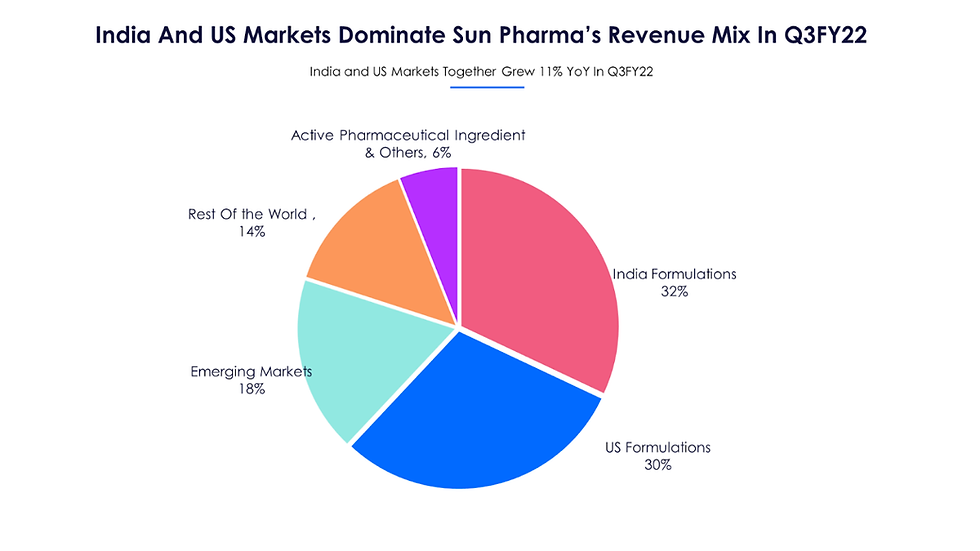

Cost control and expense management played a significant role in Sun Pharma’s profit margin growth by enhancing operational efficiency, reducing costs, and optimizing resource allocation. The company effectively managed and controlled operating costs such as production, employee expenses, and overheads, which contributed to improved gross profit margins and overall EBITDA margin expansion to around 29% in FY25. Efficient cost control allowed Sun Pharma to maintain quality and market competitiveness while reducing waste, negotiating better supplier terms, and streamlining processes.

This prudent expense management helped reallocate funds toward growth-oriented areas, including R&D and specialty segments, boosting profitability without sacrificing business performance. Overall, cost control was a crucial factor alongside product mix improvement and market growth that supported the margin expansion and sustained financial health of Sun Pharma in FY25 Renegotiating Supplier Contracts and Consolidating Orders: Businesses achieve significant savings by auditing contracts regularly, fostering strong supplier relationships for better terms, and consolidating purchases to get bulk discounts. This reduces raw material or input costs substantially without sacrificing quality.

Leveraging Remote and Hybrid Work Models: Transitioning to remote or hybrid work reduces expenses related to office rent, utilities, and maintenance, cutting overhead costs effectively.

Implementing Automation and Technology Solutions: Using automation tools for workflows, customer orders, or procurement enhances operational efficiency, reduces labor costs, and minimizes errors, boosting margins.

Streamlining Operations with Lean Practices: Applying lean management principles, such as reducing waste and optimizing resource utilization, leads to lower operational expenses and better productivity.

Zero-Based Budgeting (ZBB): This approach requires justifying expenses from scratch rather than basing budgets on past spending, helping identify and eliminate unnecessary costs.

Outsourcing Non-Core Functions: Outsourcing accounting, IT support, payroll, or marketing allows cost savings by accessing specialized expertise at a lower expense than in-house staffing.

Improving Inventory and Product Portfolio Management: Eliminating low-performing or outdated products reduces carrying costs and markdown losses, while focusing on high-margin items improves profitability.

Negotiating Payment Terms and Improving Cash Flow: Offering early payment discounts to customers and negotiating longer payment terms with suppliers can reduce financing costs and improve liquidity, contributing indirectly to profitability.

Investing in Employee Training and Retention: Skilled and engaged employees drive better productivity and sales performance, indirectly supporting margin improvement

Comments